The MEES Effect and Its Importance for the Commercial Private Rented Sector

Over the past decade, the UK’s commercial property landscape has seen meaningful change, influenced in large part by the introduction and development of the Minimum Energy Efficiency Standards (MEES).

While much of the discussion surrounding net zero and sustainability centres on large-scale infrastructure or residential housing, the Non-Domestic Private Rented Sector (PRS) has been quietly delivering significant emissions reductions, energy efficiency gains, and decarbonisation. Much of this progress appears to be directly linked to the regulatory framework established by MEES almost a decade ago, and Elmhurst have looked into quantifying that impact.

By analysing open EPC data, tracking changes in fuel use, monitoring emissions trends, and assessing regional performance across key cities, we’ve been able to build a detailed picture of how the MEES regulations have affected the performance of buildings.

What is Non-Domestic MEES?

Introduced in back in 2018, MEES first required that new leases in the non-domestic private rented sector could only be granted on properties with an EPC rating of E or higher. This expanded in April 2023 to cover all commercial leases.

However, the future direction of MEES remains uncertain. While the Government has stated its intention for all non-domestic private rented buildings to reach an EPC rating of B by 2030, the detailed policy pathway, including timelines and implementation, has yet to be confirmed. A final decision is expected following the outcome of a public consultation, currently anticipated some time in the autumn.

FIND OUT MOREKey Findings

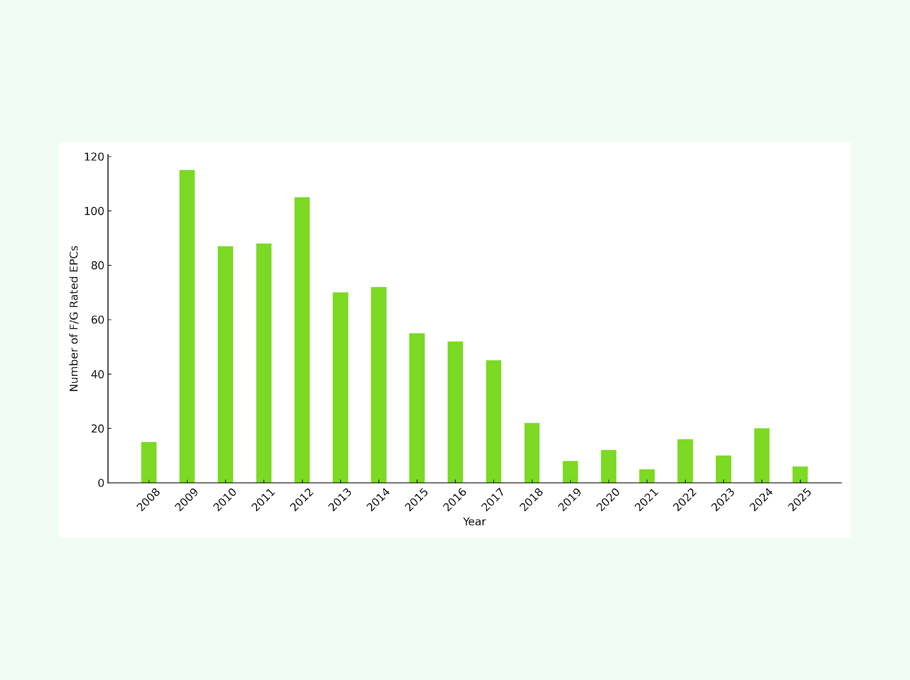

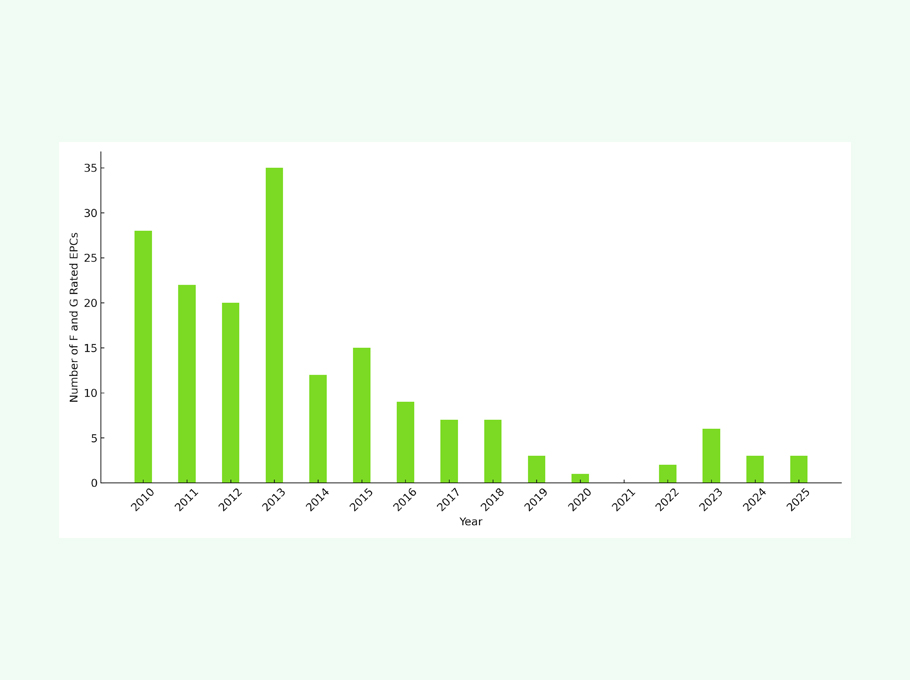

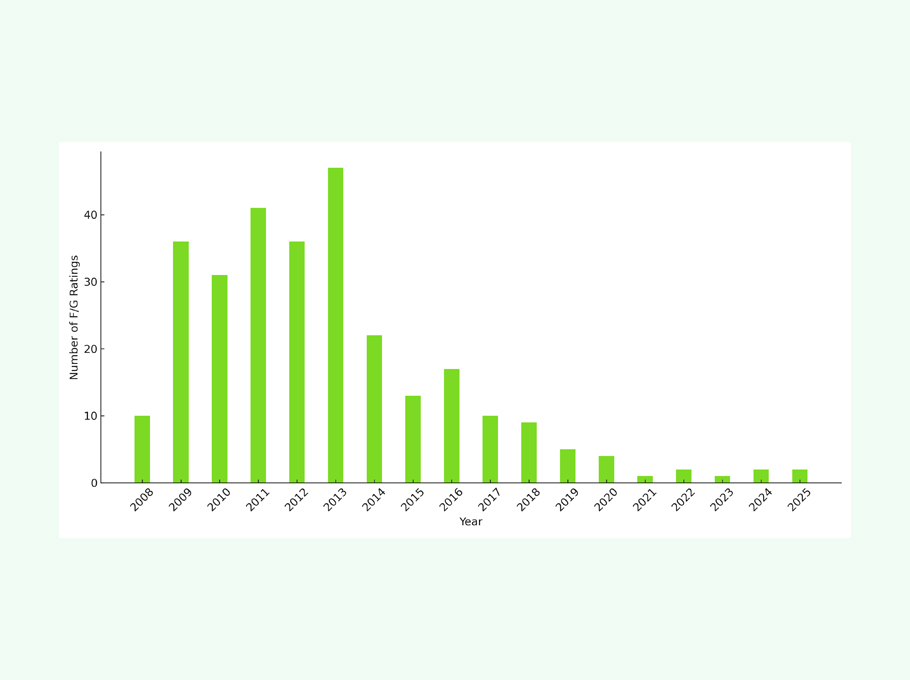

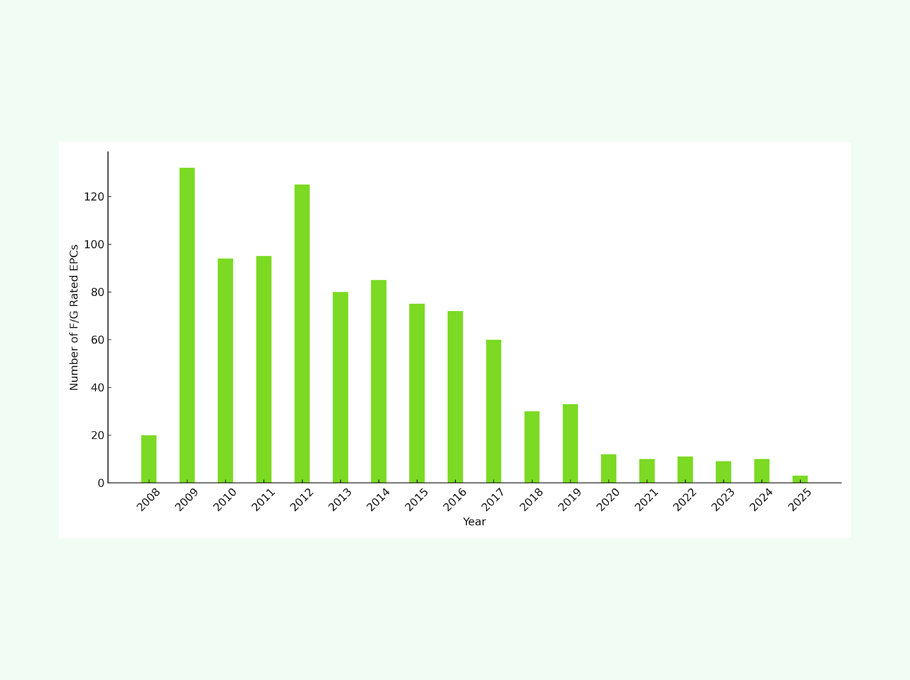

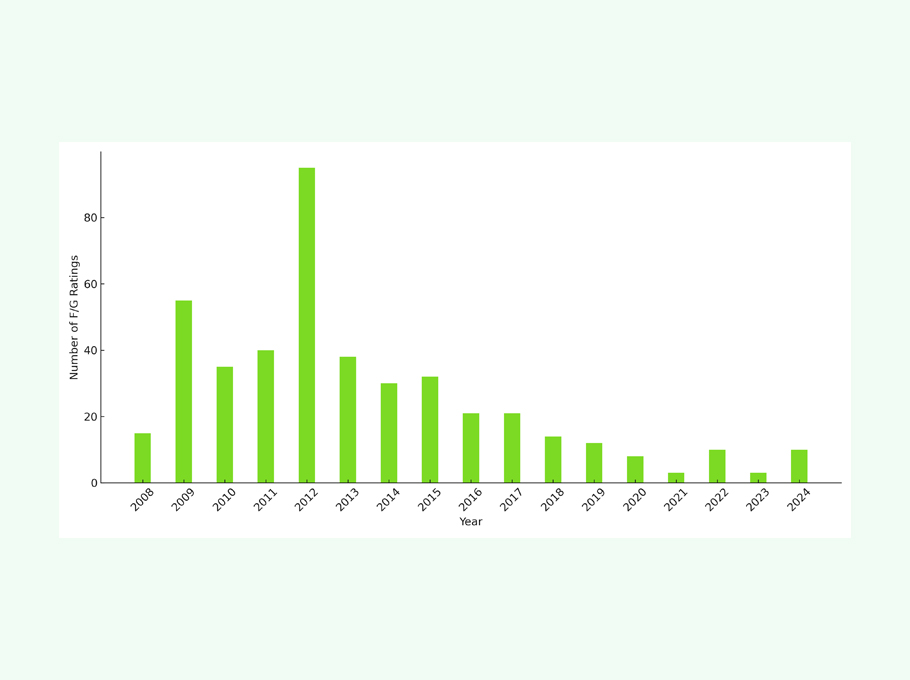

1. F and G-Rated Buildings Are Disappearing

Since MEES was introduced in 2018 and tightened in 2023, the number of F and G-rated EPCs for commercial rented properties has sharply declined. This trend is especially visible in cities such as Leeds, Leicester, Manchester, Birmingham, and the City of London, where these inefficient ratings are now rare.

Elmhurst’s analysis shows this decline isn’t incidental, it’s the result of deliberate retrofitting and improved energy management. Faced with the risk of stranded assets, landlords took action, modernising older stock to avoid unlettable properties. This marked a major shift in how energy performance is valued in the market, making EPC ratings central to asset management and due diligence.

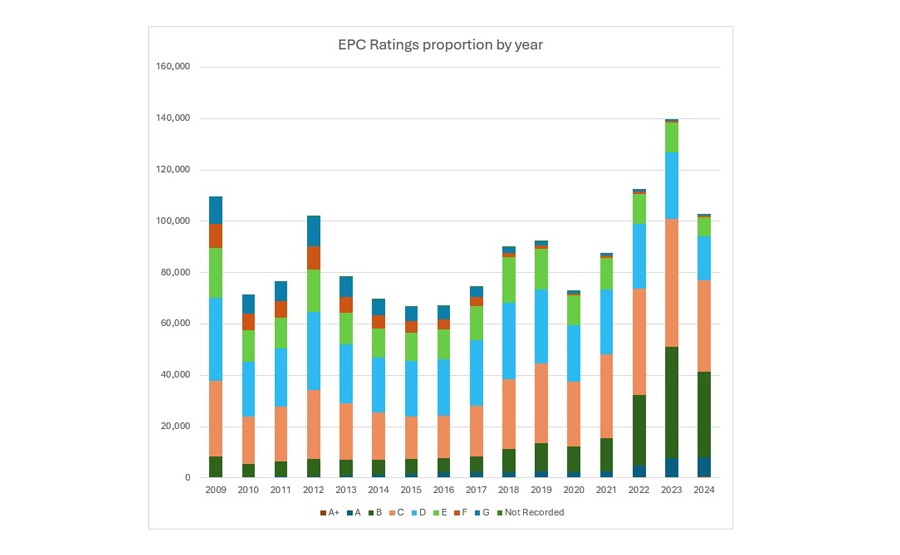

2. Commercial Buildings Are Moving Towards Higher EPC Ratings

As F and G ratings drop, there has been a measurable rise in properties achieving B and C ratings, a sign of substantial improvement across the commercial sector. This uplift became particularly pronounced from 2022 onward.

Elmhurst’s research confirms that regulatory pressure from MEES has driven this transition. This was further accelerated by changes to the non-domestic EPC methodology in 2022, which updated carbon factors to favour electricity over gas. As a result, electrically heated buildings often received higher ratings when reassessed, in some cases jumping from an E to a C without any physical improvements.

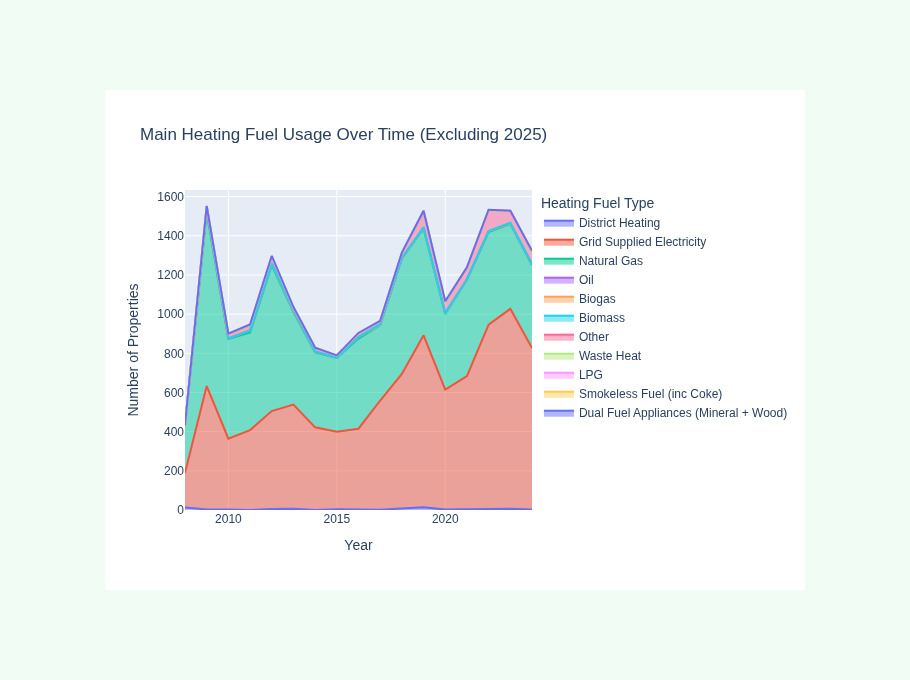

3. Energy Sources Are Changing

Commercial buildings are rapidly moving away from fossil fuel-based heating. Since 2018, there’s been a consistent increase in the use of grid-supplied electricity, with a corresponding drop in reliance on natural gas.

From 2015 to 2024, the proportion of buildings using electricity as their main heating fuel rose year-on-year. Elmhurst’s data links this shift directly to MEES enforcement, showing how regulation can drive changes that align with national decarbonisation goals.

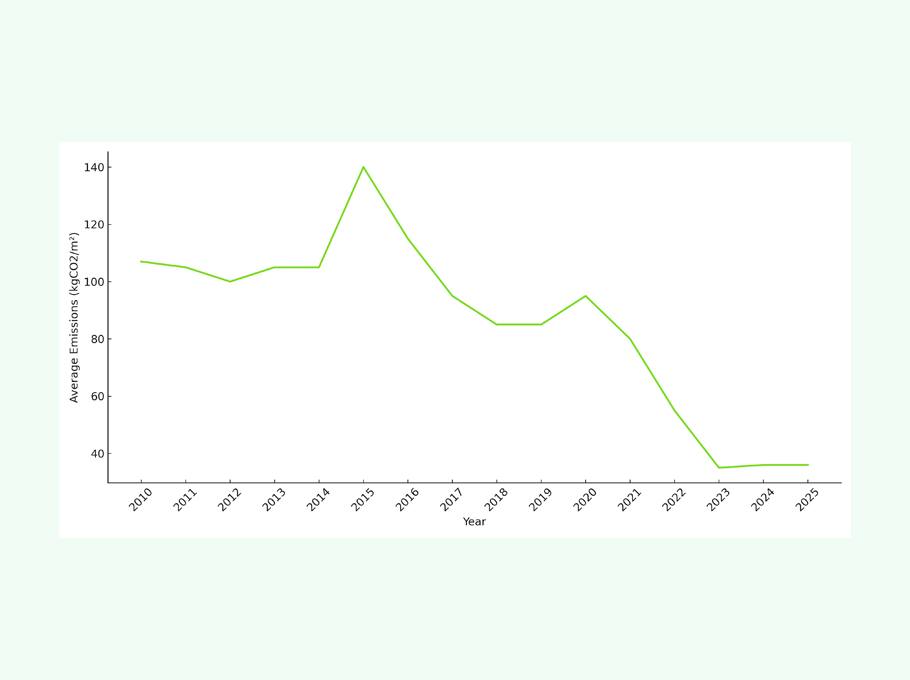

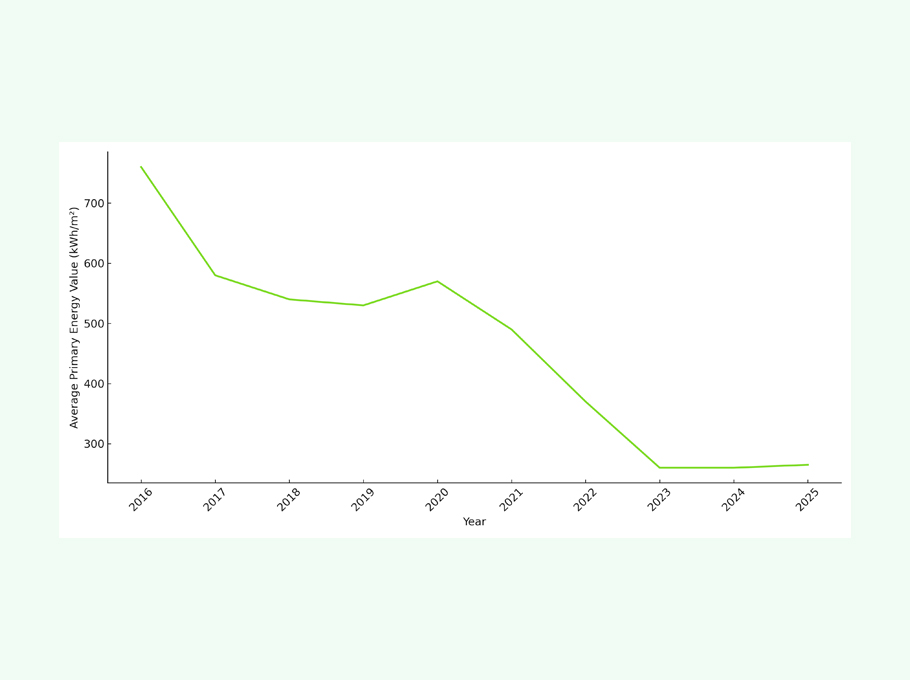

4. Emissions and Energy Use Are Falling — But Slowing

Between 2018 and 2023, there was a steady decline in both carbon emissions and primary energy use across non-domestic buildings. But post-2023 data reveals signs of plateauing.

This stall may reflect market uncertainty about future MEES targets, particularly the still-unconfirmed EPC B requirement for 2030. Without policy clarity, many landlords appear to be pausing further investment. Elmhurst warns that this policy gap risks losing the momentum that MEES has successfully built over the past decade.

Why MEES Still Matters

MEES has quietly reshaped how commercial buildings are managed, upgraded, and valued across the UK. Its influence goes far beyond compliance, driving real improvements in energy performance and market expectations. It has:

- Reduced the number of energy-inefficient buildings

- Increased demand for non-domestic energy assessment and retrofit expertise

- Helped lower energy bills for businesses

- Supported the UK’s broader decarbonisation strategy

For tenants, particularly small businesses, better building standards mean greater comfort, lower operating costs, and alignment with Environmental, Social, and Governance (ESG) objectives. For landlords, MEES has introduced a strong incentive to invest in upgrades, protect asset value, and ensure long-term marketability.

Elmhurst’s Non-Domestic Manager, John Robinson, comments:

Our findings not only highlight the environmental and economic value of MEES, but also make a clear case for continued regulatory clarity and long-term support. We’ve seen undeniable progress — fewer inefficient buildings, improved EPC ratings, and a market more attuned to energy performance.

But the job is far from done. Most commercial buildings still fall short of the proposed EPC B target, and without consistent direction from government, there’s a real risk of momentum stalling. Our data shows where improvements are happening — and where they’re not. That evidence is essential in shaping what comes next.

At Elmhurst, we remain committed to supporting the sector through this transition. We’ll continue to monitor trends, highlight emerging risks, and work with policymakers to ensure that the non-domestic PRS plays its full part in the UK’s journey to net zero.”

Related Links

https://assets.publishing.service.gov.uk/media/66b4dfe6ab418ab055593520/ND-NEED-2024-report.pdf